- Prospects for higher stock markets remain on hopes of lower US interest rates

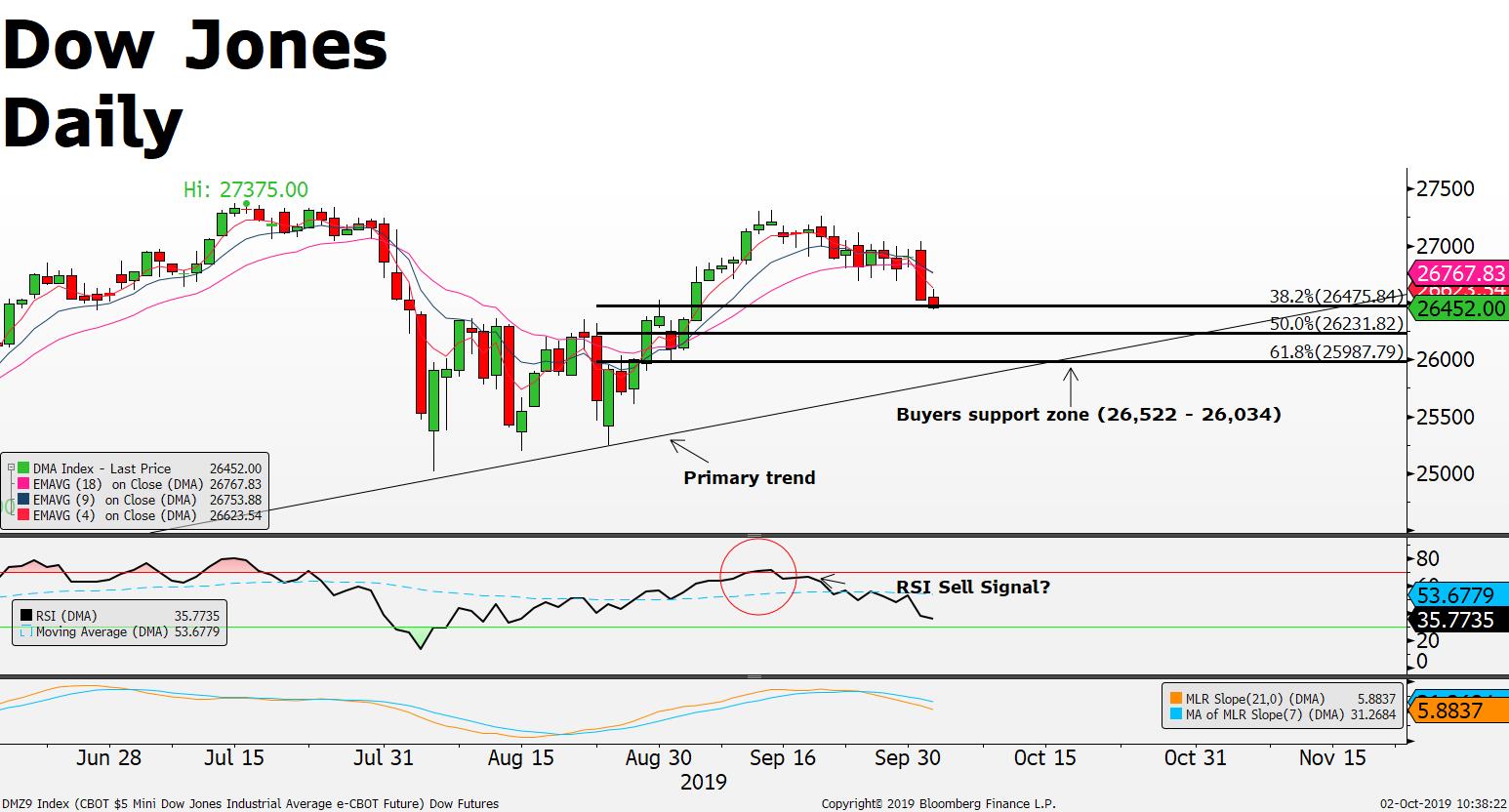

- Dow Jones 30 gained +8% (2,070 points) from the August low to September high

- Its normal for markets to corrected lower after big upward moves

- Correction levels are normally at 38.2%, 50% and 61.8% of the previous high to low advance

- Dow Jones current price 26,554 touches the 38.2%

- Buyers may be looking to enter new long positions near 26,554 (38.2%), 26,278 (50%) and 26,033 (61.8%)

UK RISK LEAVING EUROPEAN UNION WITHOUT A DEAL

- GBP/USD drops -82 pips last 5 days

- EUR/GBP gains + +50 pips last 5 days

- Bank of England may have to cut GBP interest rates if UK leaves EU without a deal, this prospect holding down GBP

- Stronger USD adds to cross selling the GBP against other pairs

CRUDE OIL (CL) WITHIN “BUYERS SUPPORT ZONE

- Crude Oil price up +1.25% near the opening EU session today

- Price moves higher on bets that the US will show a large drawdown in US crude oil inventories

- Crude Oil inventories weekly data report due later today

Source: FXGM / Bloomberg