Market Drivers

Earnings Season

Monday 28th Earnings: Spotify, Beyond Meat and Alphabet (Google)

Tuesday 29th Earnings: Pfizer

Wednesday 30th Earnings: Banco Santander, Lyft, Facebook and Apple

Thursday 31st Earnings: BNP Paribas , Repsol and Banca Generali

Friday 1st Earnings: Exxon Mobile, Alibaba Group

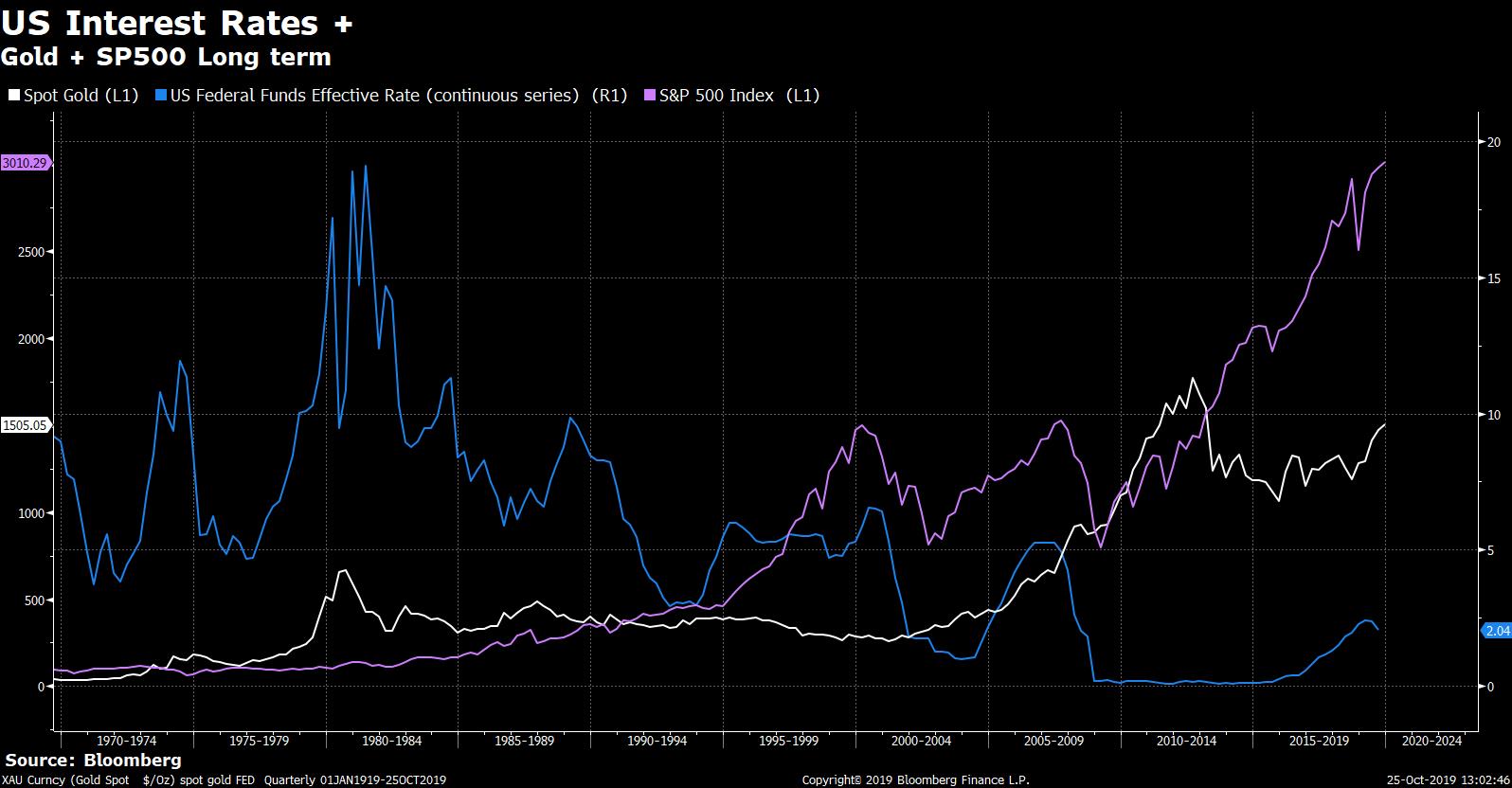

US Interest Rate Decision

Wednesday October 30th 18:00 GMT

85% of 40 economist surveyed by Bloomberg said they expect the US Federal Reserve to cut Interest Rates by 0.25%.

This would put the target range for the US Fed’s benchmark interest rate at 1.5% - 1.75%.

The US Fed has already cut interest rates 2x this year.

US unemployment remains low.

US Consumer spending remains solid.

Us Inflation remains low.

The risk of ongoing trade war tensions between US – China create uncertainty in the background.

Bottom line: Since the US Federal Reserve has failed for over 8 years to increase inflation towards its 2% target, and the fact that trade war uncertainty puts US and global economic growth at risk, the US Fed is in a position to risk higher inflation by continuing to cut interest rates as a method of stimulating the economy and boost economic activity.

How does the US lower interest rate policy affect investors?

Potential for stock market indices such as the Dow Jones 30, NASDAQ 100 and SP500 to challenge and break above their historic highs.

Potential for higher commodities prices.

Potential for increased US inflation which may increase demand for precious metals such as Gold and Silver.

Source: FXGM Investment Research Department / Bloomberg