What exactly is a bull market?

- In general, a bull market for stocks is a 20% rise in stock prices, which follows a previous 20% decline;

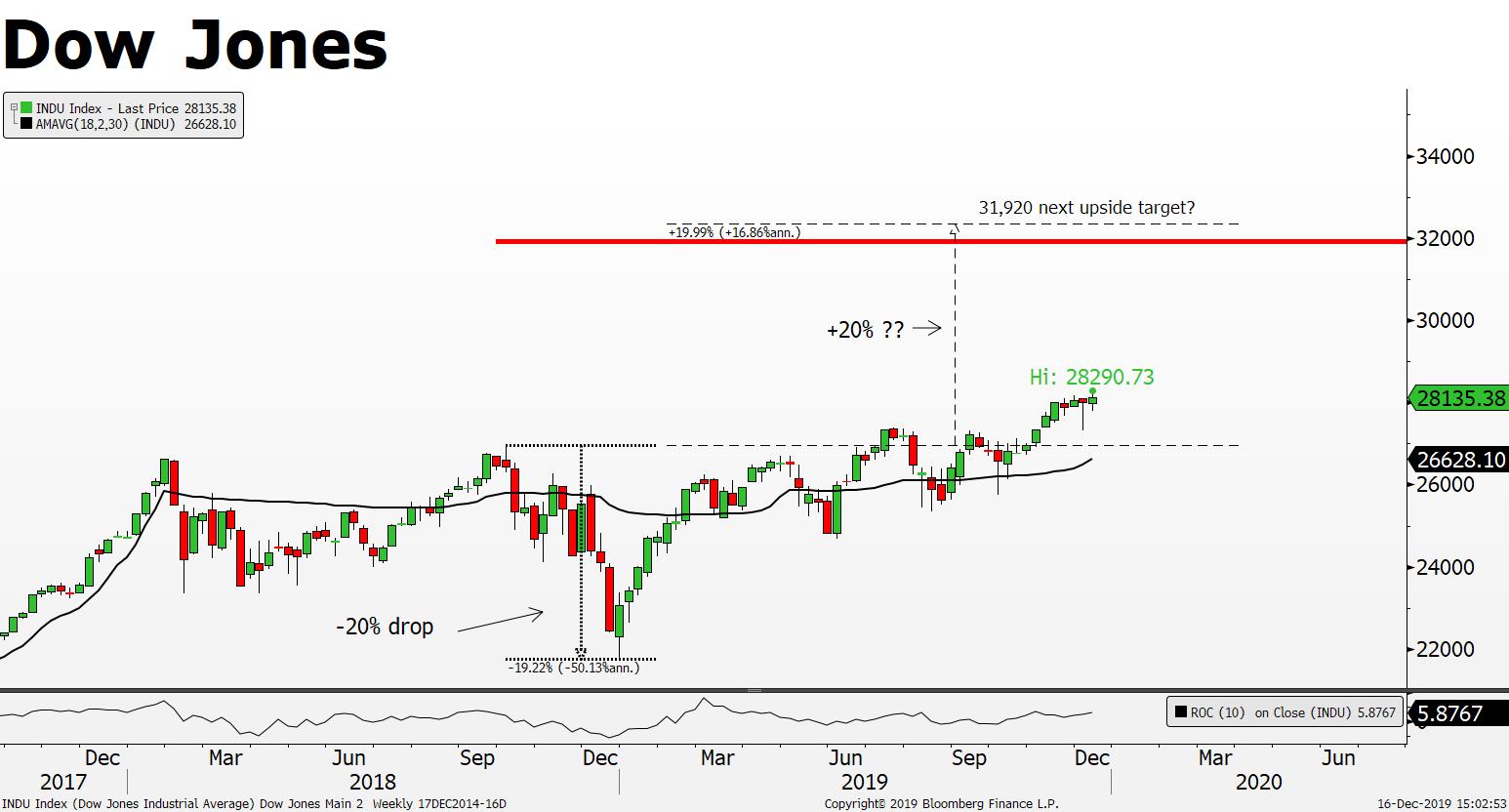

- From October 2018 to December 2018, the Dow Jones Index fell -20% from a double top high near 26,600 to December 2018 lows near 21,710;

- Applying the 20% rise rule for a bull market using 26,600 as our baseline, would imply that 31,920 could be a potential upside target for those who believe the 20% bull market rule;

Questions for Index Traders and Investors:

- If the US Dow Jones is at the start of a new bull market, which global stock indices have the highest potential to outperform the Dow Jones, European or Asian stock indices?

- If the US Dow Jones is at an early stage bull market, would a +13% / +3,700-point advance towards 31,920 from current market price 28,200 be a justified move?

- Is 26,600 a new baseline support level to add new long positions or the level to place stops?

- Is the 26,600 level the target level for short sellers?

*Stock Indices Year to Date Percentage Performances:

*Indices as of 16/12/2019 15:15 EET

Source: FXGM Investment Research Department / Bloomberg